Ministry of Finance, in the past six years has launched various schemes which have special provisions for empowerment of women. These schemes have financially empowered women to lead a better life and chase their dreams of being an entrepreneur.

As we are celebrating International Women’s Day on 8th March 2020, we take a look at various schemes initiated by the Ministry of Finance which have benefitted the women in India.

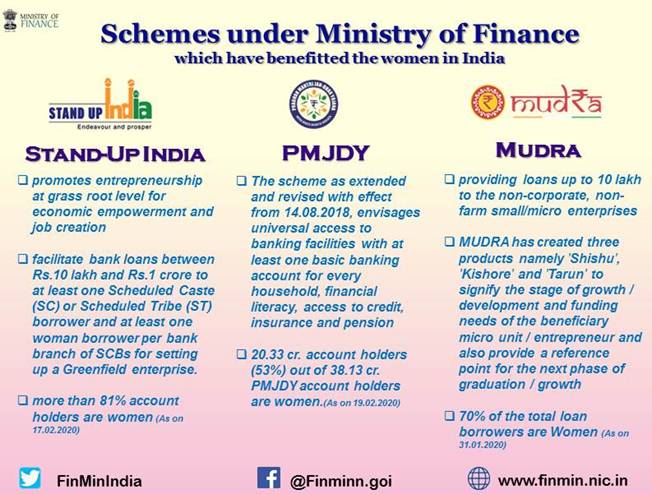

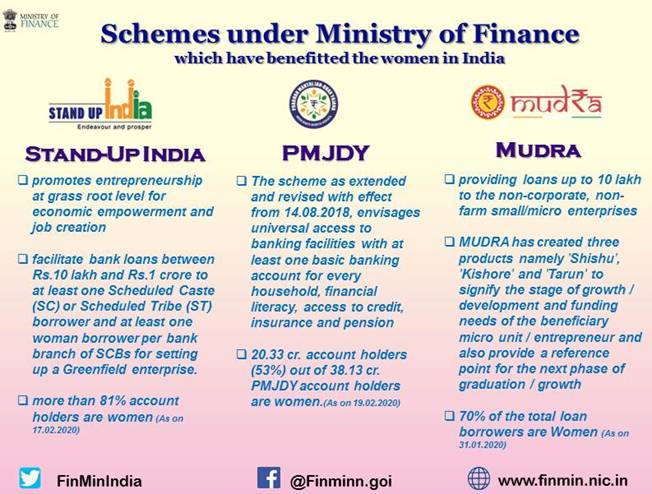

Stand-Up India Scheme

Stand Up India Scheme was launched on 5 April 2016 to promote entrepreneurship at grass root level for economic empowerment and job creation. This scheme seeks to leverage the institutional credit structure to reach out to the underserved sector of people such as Scheduled Caste, Scheduled Tribe and Women Entrepreneurs so as to enable them to participate in the economic growth of nation.

The objective of this scheme is to facilitate bank loans between Rs.10 lakh and Rs.1 crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch of SCBs for setting up a Greenfield enterprise.

As on 17.02.2020, more than 81% account holders under Stand Up India Scheme are women. 73,155 accounts have been opened for women. Rs. 16712.72 crore has been sanctioned for women account holders and Rs. 9106.13 crore has been disbursed for women account holders.

Pradhan Mantri MUDRA Yojana (PMMY)

PMMY was launched on April 8, 2015 for providing loans up to 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs.

Under the aegis of PMMY, MUDRA has created three products namely ‘Shishu’, ‘Kishore’ and ‘Tarun’ to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth.

The Vision of MUDRA scheme is “To be an integrated financial and support services provider par excellence benchmarked with global best practices and standards for the bottom of the pyramid universe for their comprehensive economic and social development”

As on 31.01.2020, more than 22.53 crore loans have been sanctioned since launch of the scheme.Out of this, more than 15.75 crore loans extended to women , thereby 70% of the total loan borrowers are Women.

Pradhan Mantri Jan-Dhan Yojana (PMJDY)

PMJDY was launched on 28th August, 2014. The scheme as extended and revised with effect from 14.08.2018 envisages universal access to banking facilities with at least one basic banking account for every adult, financial literacy, access to credit, insurance and pension

As on 19.02.2020, 20.33 crore beneficiaries out of 38.13 crore beneficiaries are women which amounts to 53 % .

Atal Pension Yojana (APY)

APY was launched on 9th May, 2015. It envisages a universal social security system for all Indians, specially the poor and the under-privilege by offering guaranteed minimum monthly pension of Rs. 1000 -Rs. 5000 at the age of 60 years.

The scheme is open for subscription through Banks and Post Offices on on-going basis. As on 22.02.2020, more than 93 lakh subscribers (43%) out of a total of around 2.15 crore subscribers under APY are women.

Old age income security is being increasingly prioritised by women as their enrolment under APY has shown a steady increase from 37% (December 2016) to 43% (February 2020). Despite low labour force participation rates and high gender wage gap, women are in the forefront of saving for old age income security as their participation is higher than men in the States /UTs of Sikkim (73%), Tamil Nadu (56%), Kerala (56%), Andhra Pradesh (55%), Puducherry (54%), Meghalaya (54%), Jharkhand (54%), Bihar (52%).

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

PMJJBY was launched on 9th May 2015. The objective of this scheme is to create a social security system for the poor and underprivileged in the age group of 18-50 years by providing a renewable life insurance cover of Rs.2 lakhs with just a premium of Rs.330.

Under PMJJBY, 40.70% enrollments are of women members and 58.21% of claim beneficiaries are women. (As on 31.01.2020)

1,91,96,805 females have enrolled out of a total of 4,71,71,568 enrollments. 95,508 claims have been paid to female beneficiaries out of a total of 1,69,216 claims paid. (As on 31.01.2020)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

PMSBY was launched on 9th May 2015. The objective of this scheme is to provide a very affordable insurance scheme for the poor and underprivileged people in the age group of 18 to 70 years with a bank account at a premium of Rs.12 per annum; risk coverage of Rs.2 lakhs for accidental death and full disability and Rs.1 lakh for partial disability.

Under PMSBY, 41.50% enrollments are of women members and 61.29% of claim beneficiaries are women. (As on 31.01.2020)

6,27,76,282 females have enrolled out of a total of 15,12,54,678 enrollments. 23,894 claims have been paid to female beneficiaries out of a total of 38,988 claims paid. (As on 31.01.2020)

Source: PIB

Image Courtesy: KNN

You may also like

-

India’s Strategic Rise Through Free Trade Agreements: Achievements and Impact (2025–26)

-

Reforming for Growth: How Policy Changes Are Transforming India’s Business Environment

-

India to Build First Riverine Lighthouses on Brahmaputra to Boost Inland Waterway Navigation

-

India Assures Energy Security Amid Rising Tensions in the Middle East

-

GPS Technology Transforms Fishing Livelihoods in Car Nicobar