SINGAPORE — India, Asia’s third largest economy, is bucking the regional trend in manufacturing activity, after February’s performance expanded at the fastest pace in 14 months, the latest Nikkei Purchasing Managers’ Index survey revealed.

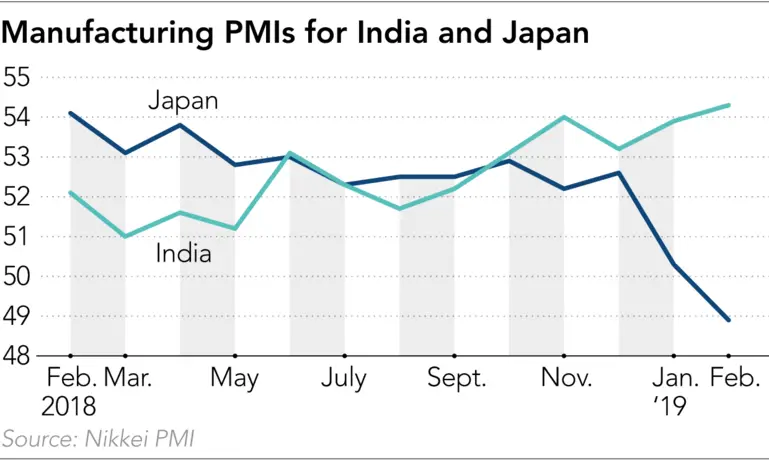

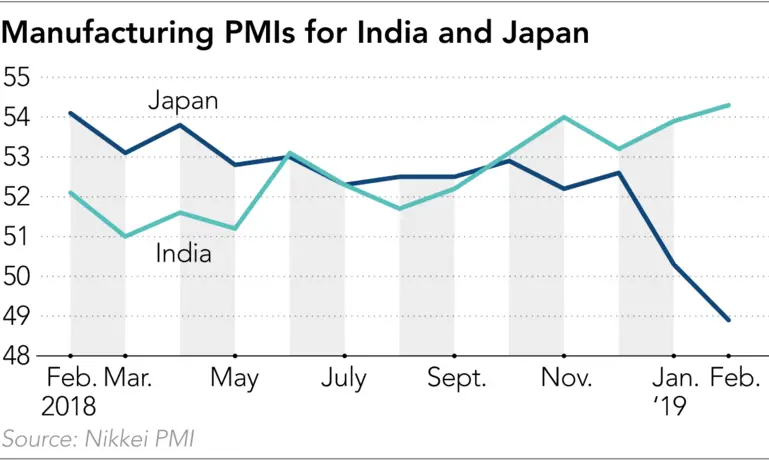

The monthly Nikkei PMI survey asks companies in major Asian countries and regions except China about changes in output, orders and other business conditions compared with a month earlier. A PMI reading below 50 indicates contraction, while over 50 points to expansion. Of the 15 sets of PMI data, nine showed a drop in February from the previous month and six rose. Looking specifically at the manufacturing sector PMIs, most of the results were down.

A notable exception was India. Its manufacturing PMI rose to 54.3 from January’s 53.9, its highest level since December 2017. The growth of new orders was fastest since October 2016.

India’s major manufacturing operations are in chemicals, machinery, metals and textiles. The country has been strengthening the manufacturing sector under Prime Minister Narendra Modi’s “Make in India” initiative. With a population of 1.3 billion and an economic growth rate at around 7% — faster than China and most Asian nations — the country has enjoyed strong domestic demand over recent months. In February, 21% of the companies surveyed signaled a growth in new orders. Local auto maker Mahindra & Mahindra, for example, sold 52,915 cars in the domestic market during the month, up 9% from a year ago.

“A number of panelists indicated the acceptance of bulk orders from clients in key export destinations,” the survey also noted.

India’s biggest export destinations are the U.S. and the United Arab Emirates, accounting for 16% and 10% of the total exports in 2017, respectively, according to the World Bank. China was its fourth biggest customer at 4%.

This contrasts with East and Southeast Asian nations, where China is the top or the second biggest export destination. China accounted for 25% of South Korean exports, 19% of Japan’s, 14% of Indonesia’s and 14% of Singapore’s, suggesting that India is not deeply entrenched in China’s value chain and therefore not heavily exposed to the country’s growth slowdown.

“Prospects for [Indian] manufacturers remain bright over the near term,” according to Shilan Shah, an economist at Capital Economics, adding that the Modi government has unveiled policies to the benefit of small and medium-sized enterprises ahead of the general election that is due by May.

On the other hand, most other Asian nations recorded lower PMIs numbers in February as they continued to be affected by the U.S.-China trade tensions as well as the global technology slump.

One country hit hard was Japan, whose manufacturing PMI dropped to 48.9 from January’s 50.3, falling below 50 for the first time since August 2016. Some of the country’s electronic component makers have downgraded their earnings guidance for the fiscal year ending on March 31. Among them was Kyoto-based motor maker Nidec, which in January downgraded its net profit forecast by 24%, citing the weakening Chinese and global economies stemming from the trade war.

“Global trade frictions and weak domestic manufacturing demand pose considerable risks to Japan’s goods producers,” said Joe Hayes, an economist at IHS Markit. “With the consumption tax hike [to 10% from the current 8%] set to come into play later this year, weak domestic demand will only heighten fears that the economy could be poised for a downturn.”

South Korea’s PMI slipped from 48.3 in January to a 44-month low of 47.2 in February due to weak export demand, and recording a contraction for the fourth consecutive month. Similarly, Taiwan’s PMI went down to 46.3 from January’s 47.5. Overseas demand reduced sharply in the electronics-driven economy, with the New Export Orders Index falling to 41.0, the lowest in seven years.

For the Association of Southeast Asian Nations overall, the manufacturing PMI dropped from 49.7 to 49.6, also due to reduced overseas demand.

Now that the U.S. and China have extended their three-month trade tariff truce beyond March 1, the outlooks appears more favorable for Asian nations.

However, the PMI numbers offered a warning against over-optimism, said Priyanka Kishore, head of India and Southeast Asia economics at Oxford Economics. “The existing tariffs are unlikely to be reduced any time soon and the ongoing slowdown in Chinese demand, which we expect to last through the first half of 2019, will weigh on the rest of the region’s exports and constrain activity in the near-term.”

Source: Nikkie

Image Courtesy: World Finance

You may also like

-

India’s Strategic Rise Through Free Trade Agreements: Achievements and Impact (2025–26)

-

Reforming for Growth: How Policy Changes Are Transforming India’s Business Environment

-

India to Build First Riverine Lighthouses on Brahmaputra to Boost Inland Waterway Navigation

-

India Assures Energy Security Amid Rising Tensions in the Middle East

-

GPS Technology Transforms Fishing Livelihoods in Car Nicobar