The government on Thursday decided to begin sale of shares that are part of “enemy property” belonging to individuals and entities who left India at the time of Partition. The proceeds from the sale of the shares held by the custodian of enemy property will form part of the disinvestment receipts, law minister Ravi Shankar Prasad told reporters after a cabinet meeting.

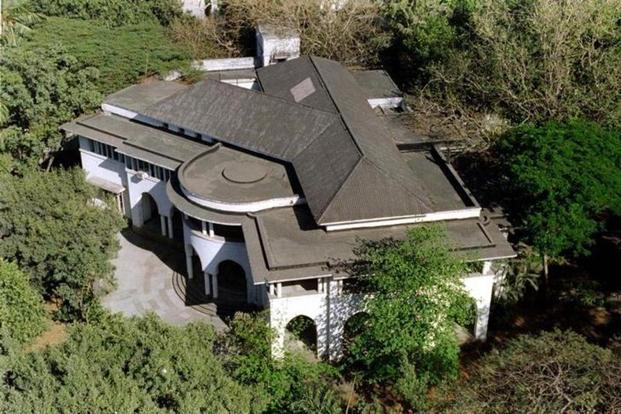

Apart from the sale – with the value of these scrips estimated at around Rs 3,000 crore at current prices – the move signals the government’s decision to dispose of enemy property, for which the government recently enacted a law. Though the current proposal deals with shares, one of the biggest such properties was owned by Raja Mahmudabad in Lucknow whose heirs had contested the move.

In all 6.5 crore shares in 996 companies of over 20,000 shareholders are under the custody of the custodian, of which 588 are functional or active companies. Of the entire lot, there are 139 companies which are listed, an official statement said. The current law had been held up in Parliament due to opposition’s objections and was issued as an ordinance before its final passage.

“The decision will lead to monetisation of movable enemy property lying dormant for decades. Sale proceeds will be used for welfare programmes,” Prasad said.

The move will also help bolster the Centre’s disinvestment receipts, which have been sluggish so far this year given the steep target of Rs 80,000 crore. With seven months of the financial year already over, the government has so far managed to raise a little over Rs 10,000 crore and is banking on buybacks to meet the target, which is crucial to maintaining the overall fiscal deficit target set for the year.

Separately, the government also decided on “strategic sale” of Dredging Corporation of India, where it holds a 73.4% stake. The shares will be sold to JNPT and Kandla, Vishakapatnman and Paradip port trusts, Prasad said.

In a statement, the government said before initiation of sale of any enemy shares, the custodian will certify that the sale of the shares is not in contravention of any court order. The sale process will be monitored by a group of ministers headed by the finance minister and the department of public asset management or DIPAM will use merchant bankers for the share sale.

Source:TNN

Image Courtesy:Live Mint

You may also like

-

India’s Strategic Rise Through Free Trade Agreements: Achievements and Impact (2025–26)

-

Reforming for Growth: How Policy Changes Are Transforming India’s Business Environment

-

India to Build First Riverine Lighthouses on Brahmaputra to Boost Inland Waterway Navigation

-

India Assures Energy Security Amid Rising Tensions in the Middle East

-

GPS Technology Transforms Fishing Livelihoods in Car Nicobar