Strong growth in revenue and operating margin during first half of the year boosted by pandemic, may help national level diagnostic firms to logout FY 2021-22 with around 55% revenue growth and 800 basis point increase in operating margins, as per a report.

As per a report by ICRA ratings, prices of diagnostic tests are expected to stabilize at current levels due to focus on volume growth and higher competitive intensity from unorganized players.

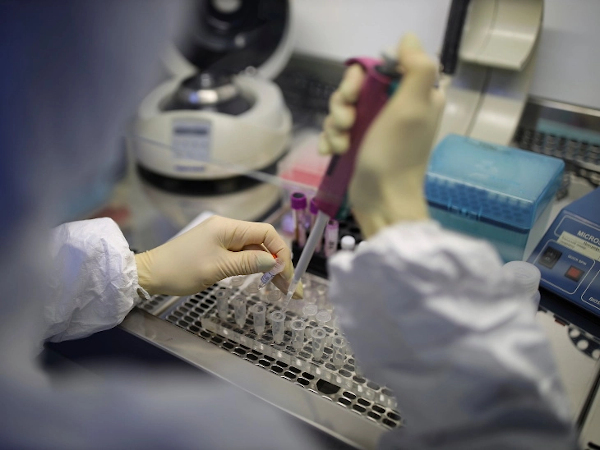

First half of FY 2021-22 witnessed a 74% increase in revenue for diagnostic industry led by players like Lal Pathlabs, Thyrocare Technologies, SRL, Metropolis Healthcare, Vijaya Diagnostic Centre, Krsnaa Diagnostics. Growth was partly due to low base and partly due to demand for COVID tests as active cases touched peek in May 2021, while non COVID tests slipped.

Realization improved due to better volume mix despite regulated pricing on COVID tests in first half of FY2021-22. As per the report Industry is set to close the year with a 55% annualized revenue growth which is likely to moderate in the second half, while for regional players revenue growth is estimated at 8-10%.

The rating agency expects operating margin levels to improve sharply to 30-32% in FY22 compared to 27.2% reported in FY21. And likely to stabilize to 29-30% during FY23 due to focus on volume growth against the existing pricing pressure.

Long term debt requirements are expected to be limited given the lower capex needs .Net debt level to remain negative for the national level diagnostic players in the near term due to sizeable cash balances and healthy accruals.

You may also like

-

India’s Strategic Rise Through Free Trade Agreements: Achievements and Impact (2025–26)

-

Reforming for Growth: How Policy Changes Are Transforming India’s Business Environment

-

India to Build First Riverine Lighthouses on Brahmaputra to Boost Inland Waterway Navigation

-

India Assures Energy Security Amid Rising Tensions in the Middle East

-

GPS Technology Transforms Fishing Livelihoods in Car Nicobar