Reserve Bank of India promoted National Payments Corporation of India (NPCI) has recently announced its permissioned blockchain-based platform, Vajra, to make the payment process easier, faster and more transparent.

Vajra is a permissioned blockchain platform which means its an closed-ecosystem platform or say “an invite-only” members club. Such permissioned blockchain network is not accessible to any random participants. Only a registered party under the network administrator can be part of the blockchain network. There will be three types of nodes on the platform.

The team at NPCI researched ‘Distributed Ledger Technology’ (DLT), a new technology that promises to provide highly secure and tamper-evident transactions stored in a distributed and immutable database which is also versatile enough to be adapted to various case.

The Vajra framework aims to derive advantage from the Blockchain framework to achieve the following goals –

- Zero/Minimal – Vajra framework will reduce manual processing, FTE for reconciliation.

- Dispute Redcution – Vajra framework provides faster resolution of disputes.

- Increased Security – Vajra framework implements cryptography, which will increase the security of payment transactions.

Vajra platform uses the notifications or otherwise can be called the distributed ledger transaction (DLT) message for handling the communication between the nodes.

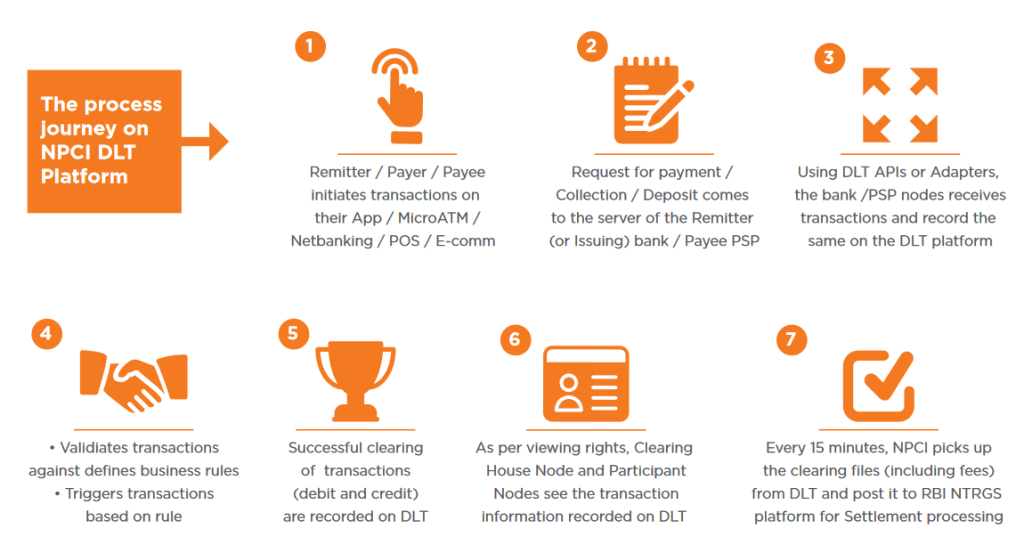

The current clearing and settlement lifecycle was assessed by NPCI, post which it defined a DLT based processing that focuses on automation of clearing and reconciliation process at NPCI and its partner banks/ASPs.

How Clearing & Settlement works on the DLT platform

Use of Artificial Intelligence & Machine Learning

Vajra platform, says NPCI, detect frauds using Artificial Intelligence (AI) and Machine Learning (ML) as well to connect to external Fleet Risk Management System (FRM) systems. These are external API’s which are going to execute against ledger data.

Other Important Features

- Permissioned Vajra network will use cryptography security for protection of data.

- Transactions to be encrypted by digital signatures (public and private keys) to prevent unauthorized parties from reading or corrupting transaction data.

- Communication between Vajra and external users to be encrypted to make Vajra data unintelligible to the latter.

- Use of off-chain DB for storing confidential data and storing only the hash pointers to those data on the DLT ledger will ensure data privacy

To recall, in March this year IBM launched IBM World Wire, a blockchain based real-time global payments network for regulated financial institutions.

Last year in October, India’s ICICI Bank became only bank from India to have joined JP Morgan’s proprietary blockchain platform called Interbank Information Network (IIN), which is built using Quorum, a permissioned (closed ecosystem) variant of the Ethereum blockchain.

Source: IW2

Image Courtesy: BernarrdMar

You may also like

-

India’s Strategic Rise Through Free Trade Agreements: Achievements and Impact (2025–26)

-

Reforming for Growth: How Policy Changes Are Transforming India’s Business Environment

-

India to Build First Riverine Lighthouses on Brahmaputra to Boost Inland Waterway Navigation

-

India Assures Energy Security Amid Rising Tensions in the Middle East

-

GPS Technology Transforms Fishing Livelihoods in Car Nicobar