NEW DELHI: Indian government officials met their counterparts from Switzerland on Wednesday to discuss cooperation in tackling black money parked in offshore accounts according to a government release. India has entered into an agreement with Switzerland under which the latter has already begun sharing information on accounts of Indian nationals in Switzerland.

Dealing with the issue of black money in foreign jurisdictions has been one of the key priority area for the government. The issue of black money was also one of the key reasons behind the move to demonetise Rs 500 and Rs 1,000 currency notes in November 2016.

“This automatic exchange of financial account information will usher a new era of financial transparency as Indian tax administration will now know the details of all bank accounts held by Indians in Switzerland,” said the government release.

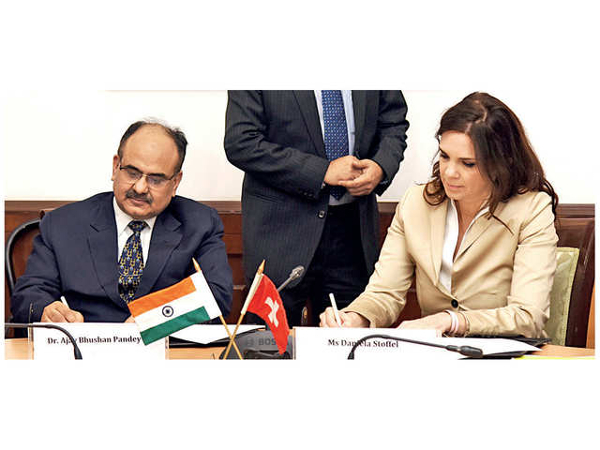

Revenue secretary Ajay Bhushan Pandey met with the Swiss state secretary for international finance Daniela Stoffel to discuss progress on the increasing cooperation between the two sides over the past few years according to the government release.

Information sharing between the two countries and the crackdown on black money has also led to a decline in the total amount of money held by Indians in Swiss bank accounts which fell nearly 6% in 2018 to 955 million Swiss francs.

Both official were satisfied with the increased cooperation between the two countries on tax administration and in particular the assistance provided by Swiss authorities in sharing the information of Indian nationals whose names were found on a list of individuals with HSBC bank accounts in Geneva.

The officials also discussed new challenges arising out of increasing digitalisation of the economy and agreed that there was a need for coordinated international action to ensure tax revenue certainty and sustainable development. Both secretaries also highlighted the need for continuous dialogue between authorities in both countries to enhance cooperation under bilateral tax treaties according to the government release.

Source: ET

Image Courtesy: ET

You may also like

-

India’s Strategic Rise Through Free Trade Agreements: Achievements and Impact (2025–26)

-

India–Finland Ties Enter New Phase as President Alexander Stubb Concludes State Visit to India

-

India–Canada Ties Get Strategic Push as Prime Minister’s Visit Yields Major Agreements Across Trade, Energy and Technology

-

INS Sudarshini Reaches Alexandria After Landmark Suez Canal Transit

-

Global Dance Overture Brings Indo–Russian Cultural Harmony to Kamani Theatre